Contents:

However, it has a relatively high chapter 3: federalism and the separation of powers due to the 1,000 barrel contract unit and .01 per barrel minimum price fluctuation. Retail’s influence rises when crude oil trends sharply, attracting capital from small players who are drawn into these markets by front-page headlines and table-pounding talking heads. The subsequent waves of greed and fear can intensify underlying trend momentum, contributing to historic climaxes and collapses that print exceptionally high volume. Having read parts 1-5, you are hopefully feeling much more confident about how to trade oil. Now all that’s left to do is sign up with a trading platform that can facilitate your desire to trade this valuable commodity.

As crude oil is traded in US dollars , the value of the dollar can affect demand from countries where buyers use other currencies. Crude oil forms with different qualities, depending on its geographical location. This means that crude oil commodity traders are concerned with the type and geographic origin of the crude oil they trade. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Fundamental Analysis

Futures contract to sell the wheat at Rs. 500 per quintal at a future date. Here are a few answers to help get you started if you’re considering trading crude oil. Either party — the buyer or the seller — can draw up a futures contract to purchase or sell at a further date.

The investor only needs to guess the direction of the rate and buy an option above or below the set price. If the investor was right, they make a profit regardless of how far the price has gone since the moment of buying the option. Brent price chartIn this article, we will talk about the peculiarities of trading oil so that everyone could understand what is this asset like and how to trade it.

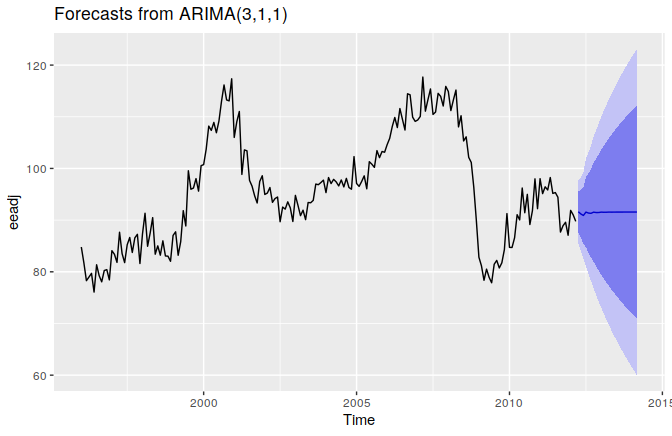

The US is a good example of this – as the US is one of the largest consumers of oil in the world, changes in its economy will affect the global oil demand. But developing countries can have an even larger impact as their demand for oil rises. Economic growth is another important factor that can have a significant impact on the price of oil. As economies grow, the demand for oil increases, leading to higher prices. In the previous article, I offered a simple oil trading strategy that included an Exponential Moving Average with period 185 and the Stochastic Oscillator with periods 25, 7, 7. This type of trading is thought to be meant only for large investors with access to the stock market.

Brent or WTI – What to trade?

Picking the right one is important if you want to make good trades. The best crude oil day trading indicator is the Stochastic RSI indicator. At least that’s what we found out after trading the Oil market for many years. Whether you are planning to trade light sweet crude oil or Brent Crude oil, futures contracts trade in 1,000 barrel increments. You’ll need to choose whether to buy or sell the market – depending on whether you think oil will rise or fall in price – and decide on your position size, which will determine the margin you pay.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Choose Between Brent and WTI Crude Oil

If you want to play the oil markets, this important commodity can provide a highly liquid asset class with which to trade several strategies. In addition, not all energy-focused financial instruments are created equally, with a subset of these securities more likely to produce positive results. Our guide found that the best online broker to trade oil is eToro. The platform is regulated by the FCA, ASIC, and CySEC, offers a demo account, ‘Copy Trader’ feature, and heaps of assets.

Growth Energy sues EPA over ‘alternative compliance’ offered to oil … – Agri-Pulse

Growth Energy sues EPA over ‘alternative compliance’ offered to oil ….

Posted: Tue, 11 Apr 2023 13:23:19 GMT [source]

https://1investing.in/ action tends to build narrow trading ranges when crude oil reacts to mixed conditions, with sideways action often persisting for years at a time. VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs – this covers shares, indices, and commodities. Most of us are never far away from our mobile phones, so you might be interested in downloading the ‘AvaTradeGO’ app.

They are designed to have similar returns to those of their underlying benchmark or asset but do not actually own the underlying assets. ETNs are riskier than traditional ETFs because they are unsecured debt securities that are subject to the credit risk of the issuer. Nonetheless, different countries have developed the level of refinery production to different levels. Which is why the United States still imports a lot of oil in order to maintain its oil production levels. This process is known as “cracking” cracking.” it turns basic crude oil into sweet high-quality oil.

- To find brokers offering oil futures, stocks, ETFs, CFDs, options, and more.

- The values of crude oil ETFs reflect daily percentage price changes.

- And More than 70% of this production was issued by the top 10 nations and 37% sourced from the current 13 OPEC states.

- The exchange trading in oil is carrying out transactions with exchange contracts, which are based on the cost of a barrel of one of the oil grades.

That, in turn, attracts traders who speculate on which way price might next head. If that is something you have a view on, read on as this guide breaks down how to trade this commodity. West Texas Intermediate is the underlying commodity of the New York Mercantile Exchange’s oil futures contract and one of the main global oil benchmarks.

The two most actively traded oil futures contracts are the West Texas Intermediate and the Brent Crude. The WTI is traded on the New York Mercantile Exchange , and the Brent Crude is traded on the Intercontinental Exchange . Crude oil trading can be profitable depending on your trading strategy, skills and experience. But, as with trading any asset, there is a risk that you can lose capital as unexpected events and excess leverage can quickly deplete your funds. Contracts for difference are one of the most popular ways to gain exposure to crude oil markets.

Step #1: Attach the Stochastic RSI indicator and the CCI indicator over the Crude Oil chart.

Unlike in the case of CFDs, you will not be charged a daily fee when investing in oil ETFs. The respective fund will be backed by the commodity in question – or stocks that are involved in this industry. One of the biggest benefits, apart from not having to own the asset – is that CFDs allow you to profit even if oil loses value (as long as you elected to short-sell). When looking at how to trade oil, you should think about whether you fancy yourself as a short-term, or long-term trader. There are many trading tools available at your fingertips to help you keep abreast with the latest news.

- The choice depends on how long traders are willing to wait for the result, and what kind of result they consider acceptable.

- And disasters as varied as pandemics and oil spills can make stocks plunge unexpectedly.

- That’s hardly surprising, as oil is used in almost every sector of the economy.

- The RAC said it does not expect this to happen in the short-term.

Understanding the basics of oil trading and the key factors that influence the price of this commodity is essential for traders looking to make a profit. This 101 introduction to oil trading will cover the major players in the market, the influences on prices, and the risks and opportunities involved. Commodity trading is when essential commodities are actively traded with the aim of speculation and management of risk. Commodity trading for speculation involves traders predicting whether a commodity’s price will rise or fall. Commodity trading for the management of risk, or hedging involves safeguarding a potential future price increase of the commodity by buying it currently .

They’re traded on exchanges and reflect the demand for different types of oil. Oil futures are a common method of buying and selling oil, and they enable you to trade rising and falling prices. You can use fundamental and technical analysis to identify when to buy and sell crude oil. You can also buy and hold a long-term position to speculate on a price trend, or take short-term positions to try to potentially profit from market volatility. You should choose a trading strategy based on your preferred approach and risk tolerance.

Special events, like the Arab uprising of 2020, saw the collapse in oil prices as the economy slowed down. And in 2022, the Russian-Ukrainian conflict saw massive disruption to the oil markets, amid rising inflation, sanctions, plus more — shoving the price of oil to more than £100 pounds per barrel. In this chapter we’ll look at all three types of commodities trading and how you can use them to make money in your portfolio. Just like with other commodities and assets, the most essential forces that affect the price of crude oil are supply and demand. Market conditions where oil supply exceeds demand cause a fall in price, whereas conditions where demand exceeds supply lead to rising prices.